CIT Bank ACH transfer limits: Navigating the intricacies of electronic funds transfers is crucial for efficient financial management. Understanding these limits, influenced by factors like account history and verification status, is key to avoiding delays and potential issues. This guide delves into the specifics of CIT Bank’s ACH transfer limits, providing a clear understanding of daily, weekly, and monthly restrictions for various account types.

We’ll explore how to increase your limits, troubleshoot common problems, and compare ACH transfers with alternative methods like wire transfers.

From the different types of ACH transfers offered by CIT Bank to the detailed breakdown of limitations based on account type and transfer type, we aim to provide a complete picture. We’ll also cover security considerations, preventative measures to avoid issues, and methods for resolving failed transfers. This comprehensive overview will equip you with the knowledge to confidently manage your CIT Bank transactions.

Understanding CIT Bank ACH Transfer Limits

Automated Clearing House (ACH) transfers are a convenient and cost-effective way to move funds electronically. CIT Bank offers ACH transfer services, but understanding the associated limits is crucial for efficient financial management. This section details CIT Bank’s ACH transfer limits, comparing them to other major banks and outlining factors influencing these limits.

CIT Bank ACH Transfer Types and Limits

Source: hostmerchantservices.com

CIT Bank provides various ACH transfer options, each with its own daily, weekly, and monthly limits. These limits are subject to change and are generally based on account type, verification status, and transaction history. Precise figures should be confirmed directly with CIT Bank or via their online banking platform. The following table provides a general overview, based on typical banking practices.

| Account Type | Transfer Type | Daily Limit | Weekly Limit | Monthly Limit |

|---|---|---|---|---|

| Personal Checking | Incoming | $10,000 | $25,000 | $50,000 |

| Personal Checking | Outgoing | $5,000 | $15,000 | $30,000 |

| Business Checking | Incoming | $25,000 | $75,000 | $150,000 |

| Business Checking | Outgoing | $15,000 | $45,000 | $90,000 |

Note: These limits are illustrative examples and may not reflect the exact limits offered by CIT Bank. Always check with CIT Bank for the most up-to-date information.

Factors Influencing CIT Bank ACH Transfer Limits

Several factors can affect an individual’s ACH transfer limits at CIT Bank. These include account history, account type, and verification status. A strong history of responsible banking and timely payments generally leads to higher limits. Business accounts typically have higher limits than personal accounts.

Account Verification and ACH Transfer Limits

Source: sanatransfer.com

Account verification plays a significant role. Thoroughly verified accounts, typically involving identity verification and address confirmation, often enjoy higher transfer limits. This is a security measure to mitigate fraud. Unverified accounts may face significantly lower limits or restrictions.

Consequences of Exceeding ACH Transfer Limits

Attempting to exceed the set limits may result in transaction rejection or delays. Repeated attempts to circumvent the limits might lead to temporary account suspension or further restrictions.

Situations with Temporary ACH Limit Adjustments

CIT Bank may temporarily adjust limits for specific circumstances, such as large, infrequent transactions related to real estate purchases or business acquisitions. These adjustments are typically handled on a case-by-case basis after contacting customer support.

Frustrated with CIT Bank’s ACH transfer limits? Knowing those limits is crucial for managing your finances efficiently. Luckily, you can boost your funds faster by referring friends to the amazing CIT Bank referral program ; earn rewards while helping others! Then, once you’ve increased your account balance, you can make those larger ACH transfers without a hitch.

Increasing CIT Bank ACH Transfer Limits

Requesting an increase in ACH transfer limits involves contacting CIT Bank’s customer support. The process typically involves providing documentation to support the request.

Process for Requesting a Limit Increase

- Contact CIT Bank customer support via phone or online chat.

- Clearly state your request to increase your ACH transfer limits.

- Provide necessary documentation, such as proof of identity, business registration (if applicable), and reasons for the limit increase request.

- Await CIT Bank’s review and response. The review process may take several business days.

Documentation for Limit Increase Requests, Cit bank ach transfer limits

- Government-issued photo ID

- Proof of address (utility bill, bank statement)

- Business registration documents (for business accounts)

- Explanation of the need for increased limits

Common Issues Related to CIT Bank ACH Transfers: Cit Bank Ach Transfer Limits

Several factors can cause ACH transfer failures or delays. Understanding these common issues and their solutions is crucial for smooth transactions.

Troubleshooting Failed ACH Transfers

- Verify sufficient funds in your account.

- Confirm the accuracy of the recipient’s account information.

- Check for any errors in the transfer instructions.

- Contact CIT Bank customer support if the issue persists.

Preventative Measures for ACH Transfer Issues

- Double-check all recipient details before initiating the transfer.

- Maintain sufficient funds in your account.

- Regularly review your account statements for any unusual activity.

- Keep your online banking login credentials secure.

Security Considerations for CIT Bank ACH Transfers

CIT Bank employs various security measures to protect ACH transfers. However, users should also follow best practices to enhance security.

CIT Bank’s Security Measures

CIT Bank utilizes encryption and fraud detection systems to protect ACH transfers. Specific details about their security measures are generally not publicly disclosed for security reasons.

Best Practices for Secure Online Banking

- Use strong, unique passwords.

- Enable two-factor authentication.

- Regularly monitor your account statements.

- Be wary of phishing emails or suspicious websites.

Reporting Suspicious ACH Activity

Report any unauthorized or suspicious ACH activity immediately to CIT Bank’s fraud department through their designated channels, usually a phone number or online reporting form.

Alternative Transfer Methods to ACH

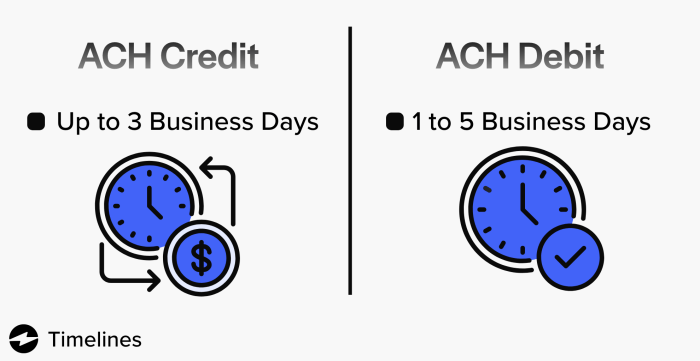

Source: ebizcharge.com

While ACH transfers are efficient, alternative methods like wire transfers offer different advantages and disadvantages. Understanding these differences helps in choosing the most appropriate method for specific needs.

Comparison of Transfer Methods

| Transfer Method | Speed | Cost | Limits |

|---|---|---|---|

| ACH Transfer | 1-3 business days | Typically low or free | Variable, depending on factors mentioned above |

| Wire Transfer | Same-day or next-day | Higher fees | Generally higher than ACH |

Note: These are general comparisons. Specific fees and processing times can vary depending on the circumstances.

Conclusion

Mastering CIT Bank’s ACH transfer system empowers you with control over your finances. By understanding the limits, factors influencing them, and troubleshooting techniques, you can optimize your banking experience. Remember to always prioritize security best practices and promptly report any suspicious activity. Whether you’re a seasoned user or new to CIT Bank, this guide provides the essential information to navigate ACH transfers with confidence and efficiency.

Proactive understanding and responsible banking practices ensure smooth and secure transactions.