Does Cit Bank charge for wire transfers? The answer, as with most banking services, isn’t a simple yes or no. The cost of sending money via wire transfer with Cit Bank depends on several factors, including whether the transfer is domestic or international, the amount being sent, and the type of account you hold. This exploration delves into the intricacies of Cit Bank’s wire transfer fees, providing a comprehensive overview to help you understand the associated costs and make informed decisions about your money transfers.

We’ll examine Cit Bank’s fee structure for both domestic and international wire transfers, comparing them to those of other major banks. We’ll also explore how factors like transfer amount, recipient location, account type (personal or business), and the chosen transfer method (online or in-person) influence the final cost. Understanding these nuances will empower you to budget effectively and choose the most cost-effective option for your financial needs.

Cit Bank Wire Transfer Fees

Navigating the world of wire transfers can feel like traversing a labyrinth, especially when dealing with fees. Understanding the cost structure is crucial for budgeting and making informed financial decisions. This guide aims to illuminate Cit Bank’s wire transfer fees, offering clarity and peace of mind in your financial transactions. We will explore domestic and international fees, compare them to other major banks, and delve into the factors that influence these costs.

Cit Bank Wire Transfer Fee Structure

Cit Bank’s wire transfer fees are structured based on several factors, primarily the type of transfer (domestic or international) and the account type (personal or business). While specific fees are subject to change, understanding the general structure empowers you to make informed decisions.

Domestic Wire Transfer Fees

Domestic wire transfers within the United States typically involve a flat fee. This fee can vary depending on the account type and may be slightly higher for business accounts. It’s always recommended to check the most up-to-date fee schedule on Cit Bank’s official website or by contacting their customer service.

International Wire Transfer Fees

Source: accory.com

International wire transfers are generally more complex and incur higher fees than domestic transfers. Cit Bank’s fees for international transfers typically consist of a combination of a flat fee and a percentage of the transfer amount. The percentage can vary based on the destination country and the currency involved. Additionally, correspondent bank fees (charges levied by intermediary banks) can add to the overall cost.

So, you’re wondering, “Does CIT Bank charge for wire transfers?” It’s a total buzzkill if they do, right? To figure out their fees, you might need to check their official site, or maybe even find the specific CIT Bank NA address and give them a call. Knowing their address might help you find the right contact info for wire transfer questions.

Bottom line: Always confirm those fees before you send anything!

It’s crucial to inquire about all potential fees before initiating an international transfer.

Comparison of Wire Transfer Fees

To provide context, let’s compare Cit Bank’s wire transfer fees to those of other major banks. The following table presents a general overview; actual fees can vary depending on the specific circumstances.

| Bank Name | Domestic Fee | International Fee | Fee Type |

|---|---|---|---|

| Cit Bank | $25 – $35 (estimated) | $45 – $55 + percentage (estimated) | Flat fee + Percentage |

| Bank of America | $25 – $30 (estimated) | $50 – $60 + percentage (estimated) | Flat fee + Percentage |

| Chase | $25 (estimated) | $45 – $55 + percentage (estimated) | Flat fee + Percentage |

| Wells Fargo | $25 (estimated) | $50 + percentage (estimated) | Flat fee + Percentage |

Note: These fees are estimates and may not reflect the current rates. Always confirm fees directly with the respective bank.

Additional Fees Associated with Wire Transfers

Beyond the base fees charged by Cit Bank, correspondent bank fees can significantly impact the final cost of an international wire transfer. Correspondent banks act as intermediaries, facilitating the transfer across borders. These fees are typically passed on to the sender. Other potential fees might include currency conversion fees (if applicable) and any charges levied by the receiving bank.

Factors Influencing Wire Transfer Costs at Cit Bank

Source: trafficpointltd.com

Several factors can influence the total cost of a wire transfer through Cit Bank. Understanding these variables allows for better financial planning and helps you anticipate the overall expense.

Transfer Amount and Recipient Location

For international transfers, the amount being sent often affects the final cost. Larger sums may incur higher percentage-based fees. The recipient’s location also plays a role, as transfer fees can vary based on the country and the corresponding correspondent bank fees.

Account Type (Personal vs. Business), Does cit bank charge for wire transfers

Business accounts often have higher wire transfer fees than personal accounts due to increased administrative overhead and potentially larger transaction volumes. The specific difference in fees will depend on Cit Bank’s current fee schedule.

Wire Transfer Method (Online vs. In-Person)

While Cit Bank likely offers both online and in-person wire transfer options, the fees are usually consistent regardless of the method used. The convenience of online transfers often outweighs any potential cost differences.

Currency Conversion Fees

For international transfers involving different currencies, currency conversion fees are usually applied. These fees are calculated based on the exchange rate at the time of the transfer, plus a markup or margin added by Cit Bank. It is important to be aware of the exchange rate and any added markup to avoid unexpected expenses.

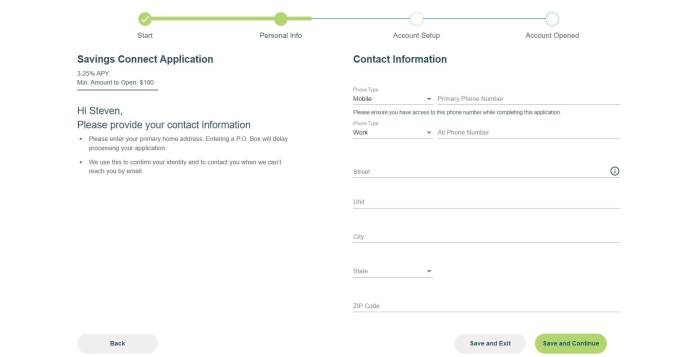

Understanding Cit Bank’s Wire Transfer Process: Does Cit Bank Charge For Wire Transfers

Initiating a wire transfer through Cit Bank involves a series of steps. Whether domestic or international, accurate information is crucial to ensure a smooth and timely transaction. Let’s explore the process for both scenarios.

Domestic Wire Transfer Process

- Log in to your Cit Bank online banking account.

- Navigate to the “Transfers” or “Payments” section.

- Select “Wire Transfer” as the transfer type.

- Choose “Domestic” as the transfer destination.

- Enter the recipient’s bank account details (account number, routing number, name, etc.).

- Specify the transfer amount.

- Review the details and confirm the transfer.

International Wire Transfer Process

- Log in to your Cit Bank online banking account.

- Navigate to the “Transfers” or “Payments” section.

- Select “Wire Transfer” as the transfer type.

- Choose “International” as the transfer destination.

- Enter the recipient’s bank account details (including SWIFT code, IBAN, etc.).

- Specify the transfer amount and currency.

- Provide the recipient’s full name and address.

- Review the details, including any applicable fees, and confirm the transfer.

Information Required for Wire Transfers

- Sender’s full name and account information

- Recipient’s full name and address

- Recipient’s bank details (account number, routing number, SWIFT code, IBAN, etc.)

- Transfer amount and currency

- Purpose of the transfer (optional, but helpful for tracking)

Processing Times for Wire Transfers

- Domestic Wire Transfers: Typically processed within 1-2 business days.

- International Wire Transfers: Can take 3-5 business days or longer, depending on the destination country and the involved banks.

Alternatives to Wire Transfers with Cit Bank

While wire transfers offer speed and reliability, other options may provide cost savings or increased convenience. Let’s compare wire transfers with alternative money transfer methods available through Cit Bank or other providers.

Comparison of Money Transfer Methods

The following table compares wire transfers to other methods, highlighting their relative strengths and weaknesses.

| Method | Cost | Speed | Security |

|---|---|---|---|

| Wire Transfer | High | Fast (1-5 business days) | Generally secure |

| ACH Transfer | Low | Slower (1-3 business days) | Secure |

| Online Payment Services (e.g., PayPal, Zelle) | Variable, often low | Fast (instant or within a few hours) | Security varies by provider |

| Check | Low | Slow (several business days to weeks) | Can be less secure than electronic methods |

Cost Savings and Time Benefits of Alternatives

ACH transfers generally offer lower costs compared to wire transfers, although they are slower. Online payment services provide speed and often lower costs than wire transfers, but security measures vary depending on the provider. Checks are the slowest and least secure option but have very low fees.

Security Considerations of Alternative Methods

Wire transfers are generally considered secure, but risks exist with any method. ACH transfers are also secure, benefiting from established banking infrastructure. Online payment services offer varying levels of security depending on the provider and its security protocols. Checks carry the highest risk of loss or theft.

Customer Support and Dispute Resolution for Wire Transfers

Should issues arise with a wire transfer, understanding Cit Bank’s customer support processes is crucial for a swift resolution. This section Artikels the steps to take in case of inquiries or disputes.

Contacting Cit Bank Customer Support

Cit Bank likely offers various methods for contacting customer support, including phone, email, and online chat. Their website should provide contact information and specific instructions on how to report wire transfer issues. It is recommended to keep transaction records and confirmation numbers for reference.

Common Wire Transfer Problems and Resolutions

- Incorrect recipient information: Contact Cit Bank immediately to initiate a stop payment and correct the information. This requires immediate action.

- Delayed transfer: Contact Cit Bank to inquire about the status and expected arrival time. They can track the transfer and provide updates.

- Incorrect transfer amount: Contact Cit Bank to report the discrepancy. They will investigate and initiate a correction if necessary.

Disputing a Wire Transfer

If an error occurs with a wire transfer, Cit Bank likely has a formal dispute resolution process. This may involve submitting a written complaint with supporting documentation, such as transaction records and communication with the recipient’s bank. It’s crucial to follow their established procedures to ensure your claim is properly investigated.

Cit Bank’s Policies Regarding Wire Transfer Errors or Reversals

Cit Bank likely has specific policies regarding wire transfer errors and reversals. These policies will Artikel the process for reporting errors, the timeframe for initiating reversals, and the eligibility criteria. It’s vital to review these policies before initiating a wire transfer to understand your rights and responsibilities.

Wrap-Up

Navigating the world of wire transfers can seem daunting, but with a clear understanding of Cit Bank’s fees and processes, you can confidently and efficiently send money domestically or internationally. Remember to consider all factors influencing the cost – from the transfer amount and recipient location to the type of account and chosen transfer method – before initiating your transaction.

By weighing the costs against the speed and security of wire transfers, and exploring alternative options if necessary, you can optimize your money transfer strategy and ensure a smooth and cost-effective experience.